Start using Member Solutions today

- Lorem Ipsum is a dummy text

- Lorem Ipsum is a dummy text

- Lorem Ipsum is a dummy text

Profit & Loss Statements: What Every Business Owner Should Know

As an owner or manager of a business, you’ve likely heard of a Profit and Loss Statement (also known as a P & L Statement). But do you know what it is and understand its components?

It’s important to understand in order for you to talk knowledgeably with your managers, bankers, tax advisors, and investors. In this article, we’ll show an example of a P & L Statement and explain what the terms mean.

A Profit and Loss Statement — or Income Statement — is one of the documents that show the financial condition of a company. Other documents include a Balance Sheet, Cash Flow Statement, and the Statement of Retained Earnings.

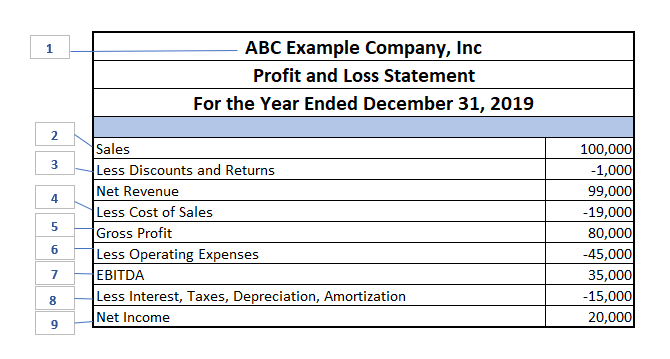

Here is an example of a P & L and an explanation of each item:

1. The first section of the Profit and Loss Statement is the heading which shows the name of the company and the period of time for which the statement relates. Every Profit and Loss Statement is for a specified period of time. It is usually for one year but could be a week, month, quarter, or any other time period.

2. The first line of the P & L, after the heading, is Sales, or Gross Revenue. This is all the money reported for sales of products and services. The term gross is used in business to mean that the item is shown prior to deducting certain expenses. After expenses are deducted, the term used is Net.

3. Next are Discounts and Returns which must be subtracted from the sales to arrive at Net Revenue. On occasion, you will see these first three lines shown as one line which would read as Revenue Net of Discounts and Returns.

4. After that comes the Cost of Sales. These are costs which can be directly traced to the products or services sold. Examples of such costs are the purchase costs of items sold, labor associated with making the products or providing the service, and sales commissions.

5. Net Revenue Less Cost of Sales arrives at Gross Profit or sometimes called Gross Income.

6. Again, it is called gross because there are still some expenses that must be deducted to show the net profit or net income. Those expenses are called the Operating Expenses. These are the expenses that cannot be directly traced to the products or services sold. Occasionally you will hear these costs be referred to as Overhead Costs. Examples of operating expenses are owner and management salaries, marketing costs, utilities, and the like.

7. After the operating expenses are deducted, we arrive at *EBITDA. This is an acronym for Earnings before interest, taxes, depreciation and amortization. EBITDA is a key indicator for companies that have a large amount of debt and/or property, plant, and equipment (fixed assets). This line shows the bankers and creditors how much money is available to run the business going forward. EBITDA is sometimes referred to as operational cash flow. This is generally not a line that you would see on the P & L of a small company with little debt or fixed assets.

8. Interest and taxes are self-explanatory.

Depreciation is the term used to spread the cost of fixed assets over a period of several years. For example, a building is purchased for $500,000. Rather than showing this cash outflow as an expense in year one, the building would be placed on the balance sheet as a fixed asset and depreciated over say 30 years. So the depreciation expense that you would see on the Profit and Loss Statement would be 1/30th of $500,000, or $16,667.

Amortization is a similar term used to account for items over a period of time greater than one year. It usually refers to loans.

9. After interest, taxes, depreciation, and amortization are deducted, we arrive at the last line which is called Net Income. This is sometimes called the bottom line. We started with Sales, which is the top rung of the company ladder, and as we deducted certain items, we descended the ladder to arrive at the bottom rung or bottom line.

We hope this brief explanation of a Profit and Loss statement helps you in all your future discussions regarding your business’s profitability.